With technological advancements and changes in customer demands—intensified by the onset of the pandemic—the insurance industry is embracing the era of data digitalization. To better compete in the digital marketplace and grow their business, many insurers are looking at data to offer more customized products and services that provide more value to their customers. Within the industry, insurers are using data to conduct risk analysis, optimize processes and workflows, improve experience, predict price changes, segment customers, and offer differentiated products. To do this faster and better, many organizations are building a modern data platform and leveraging data and analytics tools to give them the insights they need to drive better business outcomes.

Triggers of Data Platform Modernization

The insurance industry runs on data that is collected over 20-25 years. Storing such a high volume of data in legacy systems and retrieving data when required to support business operations—whether it is for monthly reporting or a customer service call—is a complex process.

In addition to volume, insurance data—such as customer data, customer feedback, help desk records, sales, and operating data—live in different silos and come in different formats that need to be structured and streamlined before they can be used. Data quality is also a big issue. Simplifying all this data to drive business value is imperative.

To democratize access to data and encourage more business users to leverage data for business decisions, insurers are shifting to digital platforms and initiating projects to improve the quality of their data, expand their data sources, gain scale and flexibility in data storage, and apply analytics to extrapolate insights that will help improve operations and increase revenue.

Data-driven organizations take their data use to the next level by offering digital services that provide a mix of services and products to the customers. These digital services leverage data for pricing, underwriting, risk analysis, claims management, and more, all intending to meet the needs of customers and provide the experience that will delight them.

Stages of Building a Modern Data Platform

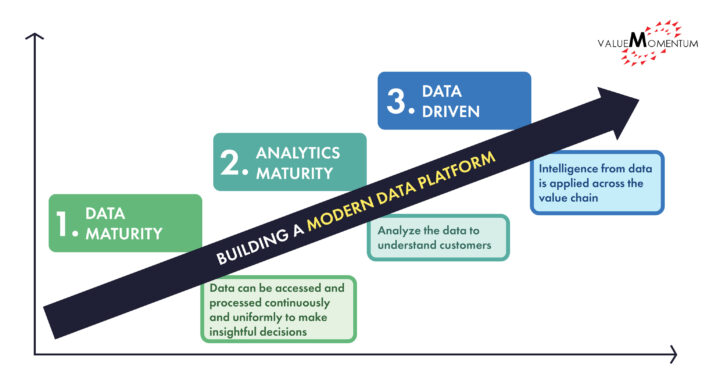

Data-driven organizations are better positioned to grow and operate with efficiency. Becoming data-driven, however, is a journey. Building a modern data platform, the first step of the journey, calls for a proper strategy and commitment, and guidance from data experts. Root level changes are required such as improving data environment, data culture, data quality, and expanding data access in the organization. To make this complex process an easy one, the journey can be broken down into 3 stages as follows:

- Achieving data maturity stage, where data can be accessed and processed continuously and uniformly to make insightful decisions.

- Achieving analytics maturity, where insurers analyze the accessed data to understand their customers.

- Being a data-driven organization, where the intelligence from data is applied across the value chain, from the underwriting process to marketing products.

Being Data-Driven for the Future

Insurers are at different stages of becoming data-driven. Based on the future needs and capabilities of their organization, insurers should modify their data environment by leveraging available tools in the market to align with the goals of the organization and move them forward in the journey. For example, many insurers are looking at cloud-native platforms—like the Snowflake Data Cloud—that can provide data access in a single source of truth that consists of both structured and unstructured data, can help encrypt and govern data, and can consume data in real-time.

Being data-driven is key to offering differentiated products and services and growing in this competitive market. To learn more about building a data-driven organization from industry experts, check out our webinar “Building a Data-driven Organization.”