In the rapidly evolving landscape of property and casualty insurance, where competition is fierce and customer expectations are soaring, an increasing number of insurers are seeking ways to enhance their operations with artificial intelligence (AI). One critical area of focus is underwriting, a data-intensive and time-consuming process that’s directly tied to profitability. Insurers have started to modernize this area by implementing AI in underwriting processes to enable efficiencies, improve service, and drive business growth.

Underwriters spend a substantial portion of their time on administrative tasks and sales support, leaving little time for actual underwriting. Further, as they search for data, whether internally, externally or both, underwriters’ accuracy is frequently compromised by manual processes and the effort to quickly analyze the best and most-current data.

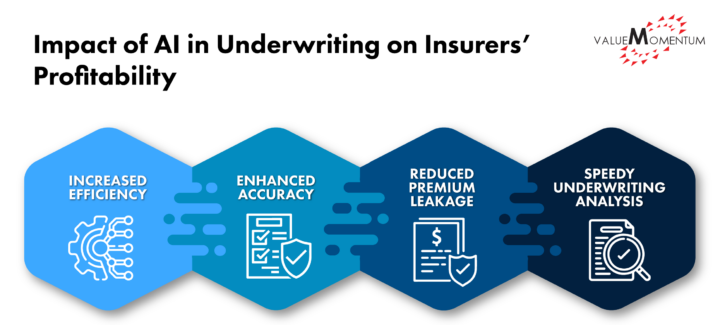

How AI-Enabled Underwriting Can Benefit Insurers’ Profitability

While the rapid maturation and adoption of AI promises substantial benefits across the insurance value chain, the benefits of AI in underwriting are having a positive impact on insurers’ profitability, including:

- Increased Efficiency: Reducing underwriters’ time spent on non-core activities could translate into billions of dollars in expense savings, a significant boon for insurance companies.

- Enhanced Accuracy: Accurate data is paramount in underwriting. With more precise information for analysis, insurers can expect fewer errors, thereby increasing the overall quality of their underwriting decisions.

- Reduced Premium Leakage: Premium leakage costs the insurance industry billions of dollars per year and can be mitigated through timely access to data, faster detection, and prevention.

- Speedy Underwriting Analysis: Enabling fast data access and reducing the time required for new business submission processing can be a game changer in a competitive market.

Recognizing these opportunities, forward-thinking insurers have started applying AI to different parts of their workflow to reimagine their underwriting processes. Here’s a look at three use cases that demonstrate the impressive possibilities for AI in underwriting.

Aerial Imagery and AI in Underwriting to Reduce Claims

Like other IoT data, aerial imagery is a data source that insurers can use to improve underwriting as well as user and customer experiences. This is especially true for homeowners’ insurance. In a recent initiative showcasing the synergy of aerial imagery and AI in insurance underwriting, a fortune 500 insurer significantly enhanced its underwriting efficiency, and reduced their homeowners’ claims and premium leakage.

The insurer extracted essential data and metadata from vendor partners, encompassing geocoding, property, parcel information, and satellite imagery. By applying machine learning models to the satellite images, the insurer could assess roof conditions, categorizing them as good, fair, or poor. Undocumented swimming pools also can be identified during this process.

These results were then integrated into an underwriting dashboard, which offers comprehensive roof information such as condition and quality scores. This dashboard helped the insurer to not only streamline its underwriting process but also identify roofs in poor condition to be repaired or to cancel/non-renew the policy.

By providing transparent and accurate information on the quality of the roofs, the insurer built trust and fostered long-term relationships with its clients. Proactively identifying maintenance and safety issues to be addressed also allowed the insurer to reduce claim denials.

This project offered the insurer more than $3.5 million in immediate financial gains, with tens of millions of dollars projected to be saved in coming years.

AI-enabled Submission Processing to Support Aggressive Growth

To improve its underwriting efficiency, a leading international reinsurer looked to natural language processing (NLP), machine learning (ML), and IBM’s Watson to automate underwriting and submission processes triggered by incoming emails.

The insurer utilized an optical character recognition engine capable of automatically capturing 30+ data points per submission. This automation streamlines what used to be time-consuming and error-prone manual data collection processes, offering more capacity and far richer and faster insights for better underwriting decisions and greater profitability.

With the automated and AI-enabled submission processes, efficiency soared. Leveraging the analytical capabilities of IBM Watson, the reinsurer implemented AI-enabled straight-through processing, which reduced processing times by 95%. What’s more, the platform’s 24/7 operational capacity vastly improved productivity and customer service, ensuring that business submissions from several continents were handled promptly, day or night.

This digital leap has had a profound financial impact. The company saw more than $5 million in premium growth as well as efficiency gains totaling more than $3 million in various operational areas. More than just numbers, these gains represent a strategic advantage in a competitive market, setting the stage for continued growth and innovation.

AI-enabled Chatbots in Underwriting for Better User Experiences

Having proven their worth with large insurers, chatbots are becoming more sophisticated and most applications center around customer service applications or on websites.

AI-enabled chatbots, drawing inspiration from generative AI models like ChatGPT, are evolving to improve customer service through better service availability and consistency as well as accelerating data access, accuracy, and decision-making.

These chatbots offer 24x7x365 availability to answer routine questions and make simple policy changes, for example, which liberates humans to engage in higher value work, such as managing relationships with agents, brokers, and customers.

AI-enabled chatbots also can generate quotes and streamline more complex and time-consuming underwriting tasks, such as appetite and risk assessment, all of which can contribute to much better user experiences due to their speed and accuracy.

By expediting underwriting analysis, reducing the errors inherent in manual work, slashing new business quote-processing time, and lowering the amount of time underwriters spend on non-core activities, AI enabled chatbots are improving service levels, capacity, and liberating resources for higher-value activities, such as relationship management.

A Glimpse Into the Future of AI in Underwriting

Applying AI across the underwriting process offers a significant step forward in the digital transformation of insurance. By using AI to streamline processes, reduce errors, and provide underwriters with timely and accurate data, insurers stand to increase efficiency and profitability while users and customers stand to benefit from faster sales and service cycles, more accurate pricing and coverage, as well as fewer denied claims.

As we’ve seen with the recent evolution of AI tools, the potential for innovation and enhancement with AI in underwriting is vast. These three AI-enabled underwriting models represent merely the beginning, signaling a promising future for insurance companies on their digital transformation journey.

To make the most out of your data with AI and other tools, check out ValueMomentum’s DataLeverage services.