Claims are a key touchpoint for retaining customers and speed in the insurance claims process is highly important in achieving customer satisfaction. While most insurers have invested in digitizing the claims process and are gathering data around the claims lifecycle to improve operations, efficient claims management is still a challenge. Learning how to apply claims management analytics to derive business insights will help insurers move on from spread sheets and create a hassle-free claims experience for both customers and employees.

Major Challenges of Claims Management

When it comes to claims management, insurers face challenges in three key areas: claims organization, customer communication, and future claim prediction.

Organizing a High Volume of Claims.

With multiple lines of business and multiple products, insurers are often dealing with multiple claims processes. Added on top of this are the document and proof requirements for each type of claim, multiplied by the volume of claims received. Organization of the claims coming in so that claims personnel can prioritize and efficiently process the claims is crucial not only to claims management, but the claims experience delivered to the end customer.

Communicating With the Customer On-Demand.

Customers want real-time updates on their claims and expect communications to be highly reliable and on demand. However, because claims go through many different steps—including evaluation, negotiation of the settlement, and payment processing—it can be a challenge to understand where bottlenecks are happening. Slow settlement can lead to poor customer retention, and even miscalculating the processing time can increase customer frustration.

Identifying Future Business Opportunities.

nsurers need to know how to leverage past results to make better decisions for the future. They need to be able to detect patterns in liability, interactions with certain lines of business, delays with certain types of claims, rate of settlements, and problem areas for customers. However, claims data can include a complicated array of variables, including customer demographics, claim circumstances, and policy details. This can make analyzing this data very difficult, as claims managers may not have the expertise or resources to detect trends or patterns.

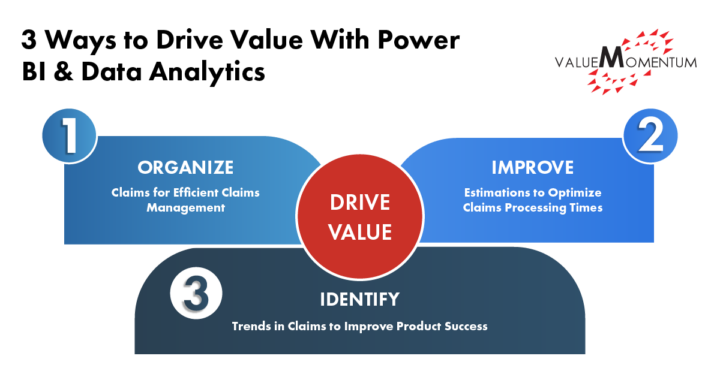

3 Ways to Drive Value With Power BI and Data Analytics

Applying Power BI and data analytics to claims management data can help insurers improve claims processing, enhance customer communication, and identify future business opportunities. Here are three ways insights from data can drive value for claims management:

-

Organize Claims for Efficient Claims Management

Insurers need a way to efficiently access and understand claims data and share analytics across team members.

By using a tool like Microsoft Power BI, claims managers can create a customized dashboard and data summaries that provides real-time views of the status of all their claims in the process, from FNOL to claim closure. Claims managers can also generate reports on open, closed and pending claims depending on multiple factors such as geographic location or LoB.

Instead of relying on multiple spreadsheets for claim status information, claim managers can migrate their current data onto Power BI’s platform and easily filter through all available data to display desired results. Multiple decision makers can use the platform with the confidence that everyone is accessing the same reports drawn from one source of data.

By creating a customized dashboard, claims managers can understand where each claim is in the process and what types of claims are on their plates, without being overwhelmed with information or needing additional IT skills.

-

Improve Estimations to Optimize Claims Processing Time

Claims managers need to accurately communicate to the customer how long the claims settlement process will take, and also understand which claims they need to prioritize over others.

Power BI allows claims managers to generate reports on settlement times based on several parameters using pre-trained AI and ML built-in capabilities. These reports can inform the claims manager on:

- the average time taken for a claim to go from first notice of loss to closure,

- how long a claim has been opened,

- claims that are breaching internal SLA processing limits,

- high-risk claims that need immediate attention,

- and costly claims that need to be expedited.

These reports and insights help claims managers see which claims to triage and prioritize. Claims managers are empowered to stay on top of problematic claims that need to be accelerated or shared with other team members. They can then give transparent and accurate updates on where the customer is in the process, and how much time it will take to finish, as well as work efficiently and quickly.

-

Identify Trends in Claims to Improve Product Success

Insurers need to be able to monitor product or policy underperformance based on previous experiences with claims and policies.

By generating loss ratio reports in Power BI, claims managers can examine historical data to evaluate if their policy premiums are set too low or high. They can constantly monitor the correlations between loss ratio and the type of claims, and factors like region and property type to better understand their products and make adjustments to product calculations as necessary.

Incorporating tools for these insights will allow claims managers to understand the state of their business capabilities and how to grow them for the future, as well as work with underwriters to evaluate risk appetites.

Better Business Insights for a Faster, Enhanced Claims Experience

When it comes to claims management, insurers need to make sure they are making the processing as efficient as possible. Usually, a claim follows a traumatic event, and customers need to feel like they are taken care of. By incorporating Power BI and data analytics tools to organize and visualize all claims data in one place, expediate processing times, and quickly generate reports that provide insight into patterns in processing and product sales, insurers can delight customers with a hassle-free claims experience.

Value Momentum has a strong understanding of insurance data and broad expertise in building and customizing intelligent data tools for insurers. We can help insurers transfer their existing claims management BA and data science models to digitized platforms in a way that maintains the company’s business objectives, while still upgrading their capabilities.

Ready to apply data insights to drive business growth? Visit our DataLeverage services to learn how we can help you leverage data to transform your business.