The IDMA 2023 Conference in Philadelphia last week from October 22-24 brought together industry experts to delve into the critical role of data management processes and how to drive business goals with targeted digital transformation initiatives.

The conference explored key data concerns across insurers, including how to support customer experience via data management, how to use AI and ML to deliver optimal decisions, as well as promoting data literacy and data culture enterprise-wide. It connected data management professionals with industry peers to collaborate, exchange new models of thinking, and expand industry understandings of where data management can proactively enable enterprise-wide digital transformation. Importantly, this year’s theme highlighted the challenge of re-channeling the business within the technical—many enterprises have often focused on data capabilities as purely technology implementations, resulting in data management practices siloed from main business objectives.

ValueMomentum partnered with client Hudson Insurance Group to tackle this topic heads on in a panel discussion titled “Unlocking Business Success: Harnessing the Power of Data Marketplaces for Actionable Insights”. The panel featured Deepak Karthikeyan, AVP of Data & Analytics from ValueMomentum, and Douglas Uss, Business Intelligence Manager, and Sateesh Mandavilli, IT Delivery & Architecture Manager, from Hudson Insurance Group. The data experts shared thought leadership and insights with data practitioners on how to leverage data products for business-aligned KPIs and data-driven insurance functionalities. In this blog, we revisit several insights from this session on how to build the right data platforms for the insurance business, as well as some necessary features and lessons learned.

Driving Insurance Value: Data Products

The panelists discussed how in order to facilitate business goals, insurers need data products: the result of a product-focused approach to datasets, ensuring security, discoverability, and trustworthiness. As shared from Deepak, data products offer high-quality, readily usable data that can be applied throughout an organization to address a wide range of business needs. This includes creating a comprehensive 360 degree view of critical entities like customers, employees, products, or branches, and delivering specific data capabilities, such as digital twins for real-world assets. These products ultimately enable data marketplaces, which increase sharing and exchange of critical data in an ecosystem.

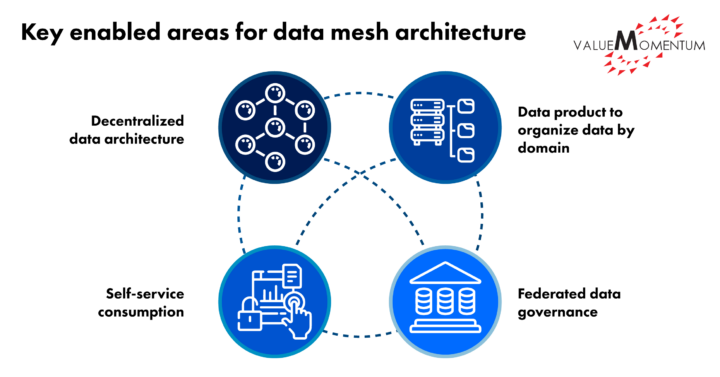

To fully utilize data products, Deepak recommended that insurers build out their data mesh architecture with the following enabled areas:

- Decentralized data architecture to facilitate scalability to accommodate the growing number of data sources, consumers, and use cases

- Data product to organize data by domain, such as policy, claims, finance, operations, actuarial, etc.

- Self-service consumption to establish a unified layer of shared data access with self-service capabilities

- Federated data governance to build capabilities such as data platform management, ingestion, quality and data governance independent of data products and as a horizontal capability for continued data management

The three speakers emphasized the importance of these features for the journey to proper data utilization, with Doug and Sateesh sharing how they are building these features out to support data consumption at Hudson.

The data mesh architecture first ingests data from insurance core systems, external sources, as well as unstructured data. The data then travels through data warehouses and data lakes for further consolidation, to cater to different consumption patterns, and to make the data accessible across BI systems, reports, dashboards, analytics, data sharing, extracts, system-to-system integration, and for discovery and experimentation.

Thus, this journey to being data-driven starts with data acquisition and progresses to the development of modern data platforms and the creation of domain-based data products designed for use-case driven consumption.

Use Case: Agent/Broker Distribution

The panelists pointed out how the timeliness of data delivery can significantly impact trust and influence behavior within the industry.

Deepak posed an example use case for the audience to consider: one insurer began offering bonuses for hitting monthly targets in addition to their commissions to improve their agent/broker experience and expand distribution.

However, the insurer was not able to deliver critical data to the agents about the business they had written more than once a month. Occasionally, that data was only available every two months. This, of course, strained trust across these very important partnerships. Then things got worse.

As a result of not having access to that data on a timely basis, some agents started placing business with other insurers. To reestablish trust and replace that lost business, the insurer decided to make that data available to agents daily.

Because IT began catering to specific KPIs and “personas,” the insurer also was able to reward profitable agents, strengthen those relationships, and foster further successful collaboration between business and IT.

By aligning their technical data capabilities with their business goals and the agents’ KPIs, the insurer was able to drive value and growth.

Harnessing Data for the Future

The insights shared at IDMA from ValueMomentum and Hudson showcase the right data foundation to support business early on in insurers’ digital transformation journey. By creating domain-oriented data products and harnessing data mesh architecture, insurers can ensure secure, discoverable, and easily accessible data for business users, agents, and customers. Furthermore, the effective use of KPIs within data products empowers insurers to align business and IT and make sure their existing data directly contributes to insurance value streams.

Ultimately, the combination of a solid technical data foundation and business outcome-oriented digital transformation enable insurers to become more proactive in utilizing data for streamlined decision-making at speed.

Learn more about how we are helping P&C insurers mature their data capabilities and become data-driven. Check out our DataLeverage Services to start your data journey today.