The entire business world is facing unprecedented challenges due to today’s global pandemic. Across industries, the future will likely unfold in unpredictable ways because of the huge uncertainty and volatility looming around the markets. Given the current pandemic’s impact, organizations are now recognizing the need for embracing a new outlook towards the way they’re doing business, and adopting new business models that will enable them to stay relevant, sustain, and even grow their business under any circumstances.

In insurance, the traditional business model consists of four key elements – (1) customers, (2) people (employees, distributors, agents, and partners), (3) processes, and (4) products/services. COVID-19 has revealed the ever-increasing need to digitally and seamlessly connect these elements to deliver frictionless, proactive, and personalized customer experiences— anytime, anywhere, and on any device. A digital insurer of the future is one who can quickly adapt to this new demand via digital transformation, thus opening up multiple opportunities to lead and shape the market.

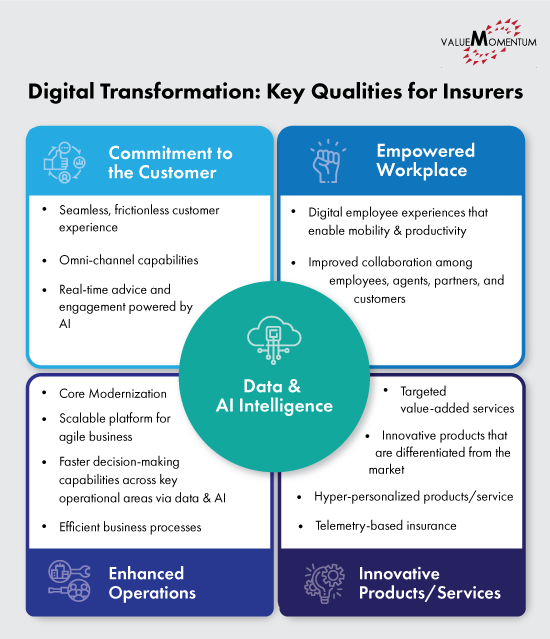

Digital Transformation: Key Qualities of a Digital Insurer of the Future

Becoming a digital insurer requires a well-connected system that links the key elements of the insurance business, as well as incorporates data analytics & AI. Moreover, it calls for a digital-first and data-driven mindset to align and strengthen all elements of the business model in order to drive digital transformation to success. To achieve such a transformation, insurers should build the following qualities into their business:

- Commitment to the Customer

The digital transformation of any organization starts with keeping customer experience at the center when designing new products/services or new processes. The 360-degree view of the customer is essential for attracting, engaging, and retaining customers—a key determinant of success in today’s intensely competitive world. A digital insurer leverages multiple digital tools & channels to understand, interact, advise, and serve customers better. Future-minded insurers should develop the capabilities to utilize real-time data and AI to gain a holistic customer view, anticipate customer needs, offer personalized and consistent omni-channel experiences, provide smart advisory, and enable their customers to make better-informed decisions. - Empowered Workplace

Accelerating workplace modernization through the adoption of digital technologies is necessary to improve employee productivity, especially in our new normal of a remote work environment. Given the potential long-term shift to work-from-home, insurers must find ways to ensure a higher degree of collaboration among employees, distributors, agents, customers, and the entire partner ecosystem. In order to empower employees to keep up with their delivery commitments, a digital insurer may start conducting remote training programs for up-skilling and re-skilling the workforce via digital learning platforms. Likewise, such an insurer should equip their agents with the latest customer relationship and service management tools, enabling agents to improve customer relationships, provide services from anywhere, and access a wider range of customer data and analytics for better decision making. - Enhanced Operations

Both now and looking forward past the COVID-19 crisis, we can expect customers to have a completely different level and scope of expectations for their insurance providers. Thus, insurers looking towards the future should focus on reimagining key operations. For example, smooth digital onboarding of customers, strong digital underwriting mechanisms, and expedited claims processing are a few initiatives that could enable insurers to meet or exceed customers’ expectations, and even unlock new revenue streams. A digital insurer is one who has taken advantage of data and analytics for faster decision making across key operational areas, as well as enhance the efficiency of various business functions such as service management, pricing, distribution, and claims processing, etc. - Innovative Products/Services

Future-minded insurers assess customer behavior by leveraging data & AI and using these insights to launch innovative products and service lines that deliver enhanced value to customers. More than ever, insurers understand that product innovation is key to differentiating themselves from the competition. Digital insurers may leverage targeted value-added services, need-based and benefit-based health insurance, pay-as-you-go motor insurance, telemetry-based insurance, etc. A more specific and recent example is making health insurance products more customer-friendly in times of crisis such as COVID-19, so that customers can get the maximum benefit from the insurance products they purchased.

Data & AI at the Heart of Digital Transformation

An insurer who can achieve transformational change and develop the four key qualities mentioned above is equipped to become a digital insurer of the future. However, at a high level, data and AI—which is fast becoming the lifeblood of almost any business – plays a critical role in developing the key qualities needed to become a digital insurer. For example, a digital insurer can leverage AI to efficiently analyze the enormous amounts of data generated out of every business transaction and conversation within their organization to improve key areas of their business. By feeding data into the AI engine, insurers can understand the behavioral patterns of consumers and make critical business decisions that achieve better outcomes. In addition, digital insurers can use data & AI to improve risk modeling, obtain deeper insight into the risk profile of customers, and better guide insurance coverage and premiums decisions.

Insurers that can harness the power of data & AI to bring transformational change across the key areas of their business, and build customer-centric business models, will put themselves on the path to becoming a digital insurer of the future.

To learn more about how to transform into a digital insurer of the future, listen to our on-demand webinar – Enabling Partners, Sales, and Customers – where an Enterprise Digital Strategy & Advisory Leader from Microsoft details an approach for bringing a digital vision into reality.

For more information on how ValueMomentum can help you advance your cloud journey, visit our Digital & Cloud page.