In a volatile economy, one thing is certain: Customer experience can help insurers stand out from the competition to retain loyalty and attract new customers. One of the major facets of customer experience is how insurers communicate with their customers. The channels, cadence, and tone a carrier uses all affect how the company is perceived. And to offer a modern customer experience, insurers need a modern customer communication management (CCM) platform.

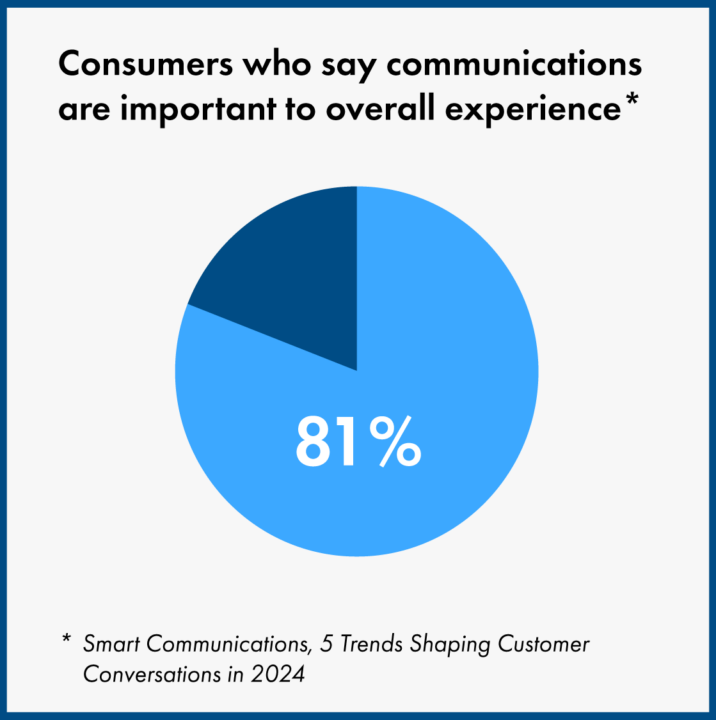

Modernizing the customer experience falls under the umbrella of an insurer’s overall digital experience strategy, but insurers cannot afford to overlook the importance of CCM. In a 2023 benchmarking reporting, Smart Communications found that 81% of consumers think communications play an important role in their experience as a whole. Personalized, customizable communication across traditional and digital channels is no longer just preferable but expected.

Modern Customer Communication Management Capabilities

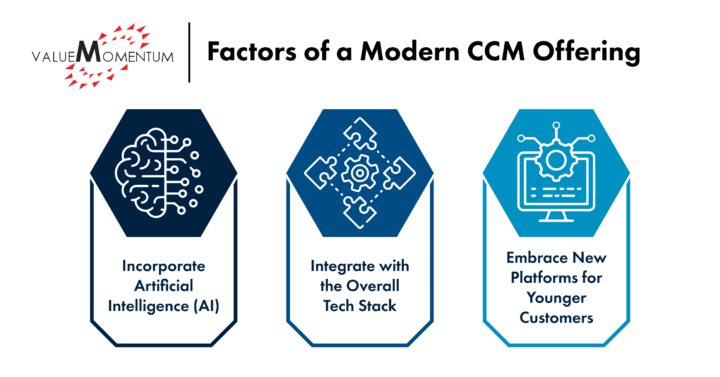

A few years ago, modern CCM options meant things like personalizing the messaging for specific persona types or adding text messages as a communication medium. But what constitutes a modern CCM offering has shifted. Now it includes factors like the following.

- Incorporating artificial intelligence (AI)

Emerging use cases for AI, such as generative AI and large language models, have been top of mind across all industries in the last year, and it is no different in the world of CCM. Improved assistance capabilities such as chatbots powered by AI and more advanced virtual assistants can help insurers provide 24/7 availability for customer questions and service needs, cutting down on issues that hinder customer experience like long phone wait times or limited customer service hours. AI can also help personalize communications based on customer information the CCM pulls from core systems or the customer relationship management (CRM) software.

- Integrating with the overall tech stack

A strong digital core is the foundation of any modernized insurer’s technology infrastructure. Whatever your CCM solution is, it should be integrated with the rest of your systems so customer data isn’t siloed and policyholders get relevant information that shows your organization knows who they are, what products and services you are providing for them, and why they chose you as their preferred insurer. In addition, being integrated with the overall tech stack ensures that information is available through any distribution or analytics partner platforms as well, ensuring you are providing a modern, data-fueled experience.

- Embracing new platforms for younger customers

Upgrading from relying solely on physical mail to digital portals was a big step for the insurance industry, but younger Millennials and Gen Z have a different relationship with technology than previous generations of policyholders. Insurers need to keep up with their customers’ preferred communication channels to stay relevant. According to Pew Research, 97% of Americans between the ages of 18 and 49 own a smartphone, and younger consumers rely on apps much more heavily than older generations do to receive their information. Digital communication is only going to continue evolving. Be ready to add new channels and features to your digital platforms to stay current with your audience.

Keeping all of these new considerations in mind when it comes to upgrading a CCM platform can be daunting, but insurers know that customer experience is a critical part of doing business. That’s why modernizing CCM features is typically tied into the larger digital strategy of an organization.

Building a strong digital core is necessary to enable the addition of other digital services and better digital touchpoints for customers. Let’s take a closer look at how one insurer upgraded its CCM capabilities as part of its overall digital strategy and provided a faster, more personalized experience for its customers.

How One Insurer Upgraded Its CCM

The insurer is a multi-line property and casualty insurer that serves both personal and commercial lines of business. It has $500 million in revenue and serves multiple states.

At the start of the project, the insurer was heavily reliant on legacy systems, with print and mail options making up the bulk of customer communication. The carrier knew it needed to upgrade its core systems and move to modern, cloud-based solutions as well as modernize its communication options to improve customer experience, accelerate form generation, and standardize its processes to boost efficiency.

After upgrading its core systems to Guidewire InsuranceSuite, the insurer focused on implementing the SmartCOMM platform to enhance and modernize its CCM capabilities by adding digital touchpoints across the multiple states and the numerous lines of business it supports. Working with ValueMomentum allowed the insurer to feel confident digitalizing, developing, testing, and expediting forms migration as well as integrating SmartCOMM with Guidewire InsuranceSuite.

After mapping the data needed for its printable forms, the implementation partner assessed the requirements needed for implementation, packaged and processed the forms data, and helped with the integration to Guidewire. Throughout the process, the project team developed and tested 850+ forms in both digital and print, removing more than 50 redundant forms in a six-month period.

The modernized templates have enabled the insurer to accelerate form generation and provide its customers with more personalized communication. SmartCOMM has also made it possible for the carrier to design and scale its customization efforts while drastically increasing its efficiency.

A Modern CCM Strategy to Drive Future Growth

As the way people communicate continues to evolve, insurers will need to keep up to make sure they’re meeting their customers’ expectations and providing modern, differentiated experiences. Upgrading CCM capabilities should be a component of any digital strategy.

To learn more about how the insurer mentioned here improved its customer experience through its CCM modernization, read the full case study.