In 2022, we experienced quite a few developments and shocks across all industries. From emerging technologies like AI, new regulations, high inflation, supply chain shortages, and talent wars, to evolving customer expectations, geopolitical conflicts, and disruptive business models, business leaders have faced an array of challenges.

In the insurance and financial services industries, the resounding theme for the year was digital customer experience. Across the industry spectrum, business leaders were tasked with becoming truly customer-centric to remain competitive in the new digital economy.

Leveraging our experience supporting clients through business transformation initiatives throughout this year, we’ve created content to share project insights, best practices, tips, and tools to guide others through the same journey. Here’s a look at the content topics that our audience of IT and business leaders found to be the most valuable in 2022.

From blogs to webinars and case studies, here are resources to help you realize the greatest return on your digital customer experience investment.

Digital Transformation

With the insurance and banking landscapes becoming increasingly digital, successfully completing your own digital transformation journey is a business imperative.

-

White Paper: Building Your API Foundation

The digital revolution has brought collaboration to the forefront. Insurers need to partner with businesses within and outside their industries to build an effective digital ecosystem, which enables new modes of monetization, superior digital customer experiences, and a broader range of products and services.

APIs are the linchpin to effective collaboration, which most insurers understand but still struggle to implement successfully. The majority of carriers today still have more API questions than answers—especially when it comes to partner integration.

This actionable, no-nonsense white paper—“Building Your API Foundation: A How-to Guide for Leveraging APIs for Partner Integration”—can help insurers plan their distribution strategy and build an ecosystem of partners to bring greater value to their customers.

The white paper will teach you the four primary digital distribution channels for insurers, dispel the major myth surrounding API adoption in insurance, troubleshoot common challenges most insurers encounter, and outline the technical capabilities your API foundation needs to be successful.

Data Analytics

The old business adage “you can’t manage what you can’t measure” rings truer than ever in the digital era. One of the great advantages of operating in the digital sphere is the incredible volume of data available. However, realizing data’s full strategic potential requires building capabilities to properly collect, organize, analyze, and interpret the data.

-

Analyst Report: Delivering Insurance Business Value With Enterprise Data Strategy

As the insurance industry increasingly matures in a customer-centric, automated, and augmented decision-making direction, it’s more important than ever to build an enterprise data strategy. Such a strategy enables enterprise access and establishes a single source of truth, which helps organizations leverage data more for business insights and build a data-driven culture.

Informed by Aite-Novarica Group’s CIO survey, this analyst report—Delivering Insurance Business Value With Enterprise Data Strategy—reveals the experiences (from challenges to victories) of 10 property and casualty insurance carriers who are investing in their data strategies.

-

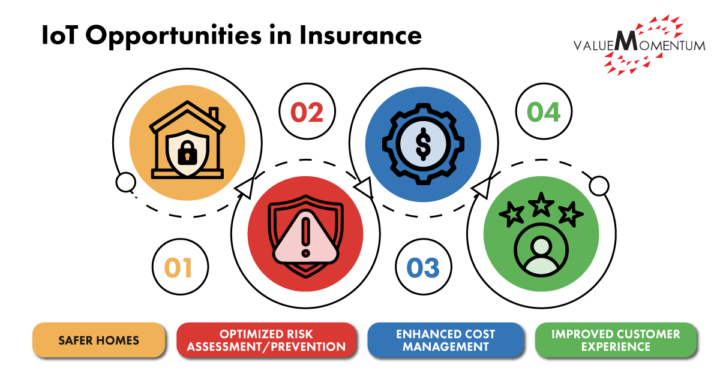

Blog Post: IoT in Insurance

IoT (Internet of Things) already has a daily presence in the lives of most consumers and businesses. However, its true potential for the insurance sector is still untapped. Among other opportunities, this ecosystem of connected devices offers the ability to develop more personalized products, improve cost management, enhance risk prediction and prevention, and support a more positive and profitable digital customer experience.

In our blog post—IoT in Insurance: Opportunities and Challenges—we surveyed the current IoT landscape in insurance and shared how insurers can capitalize on business opportunities with IoT.

From safer homes and optimized risk assessment and prevention, to enhanced cost management and improved digital customer experience, IoT affords many incredible opportunities to P&C insurers. The blog post also covers several of the specific challenges those insurers face—like data security, data management, and adoption difficulties—and provides solutions to them.

Core System Transformations

As the insurance landscape is rapidly shifting beneath the weight of new technological advancements, digital consumerization, innovative business models, and novel customer demands, insurers are charged with expanding their core systems to remain stable and competitive.

-

Case Study: NJM Implemented BOP & CUMB Coverages in Guidewire

In their mission to become a full-service, multi-line carrier, NJM Insurance Group partnered with ValueMomentum to add Business Owners Policy (BOP) and Commercial Umbrella (CUMB) lines to their Guidewire PolicyCenter core system.

The implementation of the new business lines was completed over 13 months, establishing the groundwork to support new distribution models and greatly enhance NJM’s range of products so they can better satisfy their customer’s needs. After building an “Agency Channel” for BOP and CUMB, NJM now enjoys new and profitable sales channels and revenue streams, along with 440 ISO and carrier-specific forms with reusable elements and customization abilities.

AI and Automation

Insurers are turning to AI and automation to manage progressively larger volumes of data, so they operate at the speed of digital in an increasingly competitive environment.

-

Webinar: QA Automation Testing Demystified

Many insurers rely on quality assurance and testing strategies to deliver high-volume product and enhancement releases. Automation is the key to expedient and effective testing, enabling insurers to improve testing efficiencies, drive speed-to-market, and provide a superior digital customer experience.

Many insurers rely on quality assurance and testing strategies to deliver high-volume product and enhancement releases. Automation is the key to expedient and effective testing, enabling insurers to improve testing efficiencies, drive speed-to-market, and provide a superior digital customer experience.

In our actionable, audience-driven webinar—Ask the Experts: QA Automation Testing Demystified—a panel of industry experts share how insurance IT leaders can successfully drive their QA strategies, as well as adoption tips for leading QA automation efforts in your own organization. They also answer a variety of quality assurance, quality engineering, and automation testing questions to help you better understand and implement successful QA automation testing.

Moving Into 2023

Based on the topics that business and IT leaders engaged with in 2022, it’s clear that digital customer experience is a multi-faceted journey. Organizations that focus on successfully completing their digital transformation journeys, building out their data and analytics capabilities, developing agility into their core systems to support business expansion, and leveraging AI and automation to optimize operations are setting themselves up to drive more customer success in the new year.

If you’d like to learn more about how ValueMomentum can help you achieve your business goals—even beyond digital customer experience—you can learn more about our services here.