As the insurance industry becomes increasingly digital, insurers are investing in data to remain competitive. Specifically, insurers are leveraging data to mine customer insights, claim new market share, drive operational efficiencies, power analytics to reduce risk, and build and deploy personalized products and services at speed.

Unfortunately, most insurers are still struggling with antiquated legacy systems and traditional technologies that not only limit speed to market but also create major obstacles for them on their journey to becoming data-driven.

In today’s dynamic insurance environment, it’s necessary for insurers to harness real-time data to drive intelligent decision-making and business outcomes at the speed of digital. Doing so requires insurers to modernize their data environment— and more specifically, to adopt a modern data platform.

Challenges to Establishing a Modern Data Platform

Transforming the data environment to support business growth demands that insurers address the data challenges in their organizations. These challenges include data organization, governance, and security; cultural inertia; and legacy architectures.

Managing Data Organization, Governance, and Security is Difficult.

Multiple legacy core systems negatively affect the ability to integrate data from diverse data streams, while siloed data centers negatively affect data harmonization and consolidated data stores. As a result, data quality, governance, and security suffer.

A modern data platform, however, can ingest and process real-time, streaming, and high-volume data (like telematics), enabling insurers to quickly introduce and update new products and services. In particular, a modern data platform is especially effective at optimizing data volume, variety, and velocity.

Overcoming Cultural Inertia Requires Concerted Enterprise Effort.

In the fight for data modernization, there are two fronts. The first—the technological one—insurers understand. They’re quick to focus on selecting and implementing technologies that identify, extract, and store data. However, they often neglect the cultural front, which can be just as important. A modern data platform won’t drive much business benefit if it’s improperly used or underutilized.

After solving the technological challenges of data modernization, insurers should turn their attention to the cultural ones. Generally, IT and business teams are resistant to change and need to be educated on how a modern data platform can simplify and standardize their data-to-day operations, as well as offer new tools and capabilities to improve business processes and outcomes.

Evolving Beyond Legacy Architectures is a Business Necessity.

Insurers who rely solely on dated architectures will struggle to take full advantage of the data opportunities and innovative tools that can positively impact their business growth.

A modern data platform is designed from the ground up to accommodate advanced data capabilities through IoT and handle more customer data touchpoints, as well as generally optimize decision-making, automate key processes and testing, and develop self-service business intelligence that distill actionable insights for business benefits. From enabling new technologies and tools, to optimizing and automating existing processes, a modern data platform is necessary to even participate in the new digital economy.

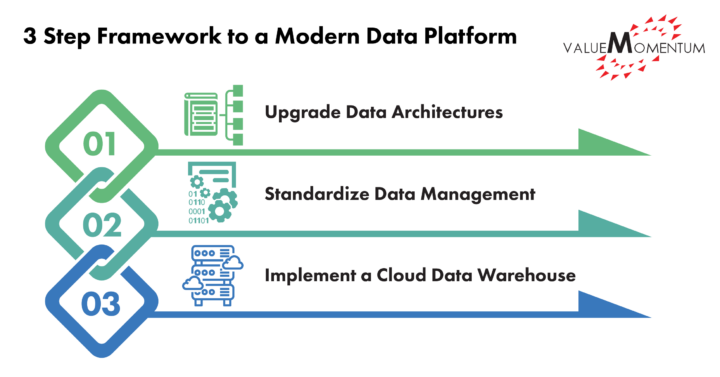

A 3-Step Framework to a Modern Data Platform

The journey to establish a modern data platform comes down to addressing three major areas: the data architectures, data management and data warehouse.

1. Upgrading Data Architectures to Enable Agility and Flexibility

Many insurers continue to operate on legacy systems, on-premise servers, and siloed data in various formats that are not efficiently accessible by the right parties at the right times. Though the capacity to collect real-time data has improved with the development of artificial intelligence (AI), legacy sources largely fail to process the variety of data that is becoming more available to insurers. Insurers must employ data architectures that can store an array of both traditional and nontraditional data. This includes but is not limited to paper forms, smartphones, videos, wearables, drones, and more. An effective data architecture will allow insurers to scale their data up and down based on business needs.

2. Standardizing Data Management to Optimize Operations

Along with the ability to store vast amounts of data, insurers struggle with the management of data. Organizing multiple data streams—including both historical enterprise data and third-party sources—and enabling analysis can be time-consuming and labor-intensive. AI-powered automation and machine learning will be crucial to streamline data management. Insurers will further benefit from advanced delivery methods such as Agile and DevOps to advance their data management systems, maximize continuous integration/continuous delivery, and accelerate speed-to-market for new capabilities. Ultimately, insurers must centralize data access, define rules and standards for how data is curated for business analytics, and ensure security and compliance for proper management and utilization of data.

3. Implementing a Cloud Data Warehouse to Provide Scale and Innovation

As data sources and data volume increase, the ability to scale, store, and access innovative tools for data computation becomes more and more necessary to compete. While Insurtechs have been employing data technology early on to disrupt legacy companies in the industry, insurers have been slower to adopt new technology. This trend is changing, however, as incumbent insurers are employing cloud technology and transitioning to cloud infrastructures to support their data initiatives. Cloud data warehouses are a platform many are considering or taking up to leverage their varied data sources and new technologies in AI and ML to maximize data analytics.

How One Insurer Built Their Modern Data Platform

A regional property & casualty insurance company, burdened with increasingly obsolete on-premises SQL servers and data warehouses, resolved to build a modern data platform to drive data accessibility and deploy cloud-specific tools to better collect, analyze, manage, and interpret data. The insurer decided to migrate their data—over 4 terabytes, including more than 200 tables of data—to the Snowflake Cloud Warehouse

• The Project: Data Migration to the Cloud

The migration was ambitious. In addition to the incredible volume and variety of their data, they planned to complete the migration in just three weeks. To meet this goal, they partnered with ValueMomentum’s DataLeverage team to help set up, configure, and provision the Snowflake data warehouse of their data migration.

• The Process: Provisioning Accelerators

The ValueMomentum Data team created a data structure in Snowflake to house the insurer’s legacy data. Then, the team built three accelerators that were provisioned to understand the location of the SQL server, the name of the data warehouse, and its migration destination, while rapidly sorting and processing a large diversity of data. After passing bug and error tests in a dry run, the accelerators performed the data migration through end-to-end automation. The accelerators moved more than 200 tables of data in only 5 days—20 times faster than it would have been accomplished manually.

• The Benefits: Open Access

After their data migration to a cloud data warehouse was complete, the insurer was able to execute data cutting-edge management processes, wield AI-based tools for analytics, and democratize access to their data—enabling more business users across more business functions to access, interact with, and leverage data to drive business outcomes.

A Modern Data Platform for the Future of Insurance

While insurers understand that data is key in the age of digital transformation, they still face several challenges along the road to data modernization. A modern data platform is the first and most necessary step toward data modernization.

And though building a modern data platform has its own challenges—from managing data organization, governance, and security to breaking free of cultural inertia and updating legacy architectures—there is a simple 3-step framework to overcoming them.

Are you ready to start your data modernization journey? Review ValueMometum’s Modern Data Platform services to see how we can help you modernize your data platform and prepare you for data-driven success.