Insurers already recognize the importance of leveraging data analytics to provide better products and experiencesfor their customers. Yet, traditional challenges—such as legacy reporting infrastructure, IT-centric user interface on tools, and inability to digest data from multiple sources—hinder insurers’ ability to derive consistent value from data tools. Importantly, business still relies heavily on IT teams to pull, aggregate and organize data for reporting and day-to-day operations. As a manual workflow, this process generates operational inefficiencies and reduces IT’s agility and work capacity. To solve this key challenge, many insurers are turning to business-led analytics tools on the market—specifically Power BI—to enhance their business intelligence capabilities and democratize data access across their organization.

Successfully leveraging BI tools, however, requires insurers to have a data foundation that supports modernized, next generation self-service business insights tools. Additionally, having a clear, company-wide approach to incorporating BI assures everyone has access to data, knows how to use data to derive insights, and consistently apply insights to drive their business decisions–from underwriting to claims, operations, actuarial, agents and legal teams.

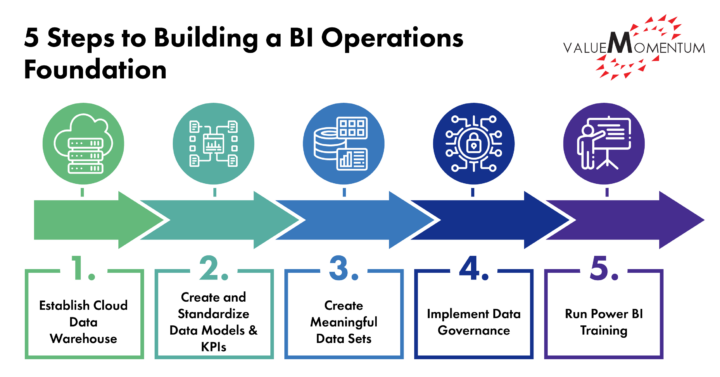

Here are 5 steps insurers can take to develop the foundation needed to standardize and improve BI operations with Power BI:

5 Steps to Build the Foundation for Standardized BI Operations:

1. Establish Cloud Data Warehouse for Data Storage

Insurers today deal with data from an ever-growing number of sources—from customer information and feedback, sales and operating data, third party data, and social media data to IoT data coming from many devices. All this data needs to be stored in a central, secured repository to ensure that they can be fully leveraged and analyzed for insurance business insights.

A modern, cloud-native data warehouse can store and process structured and unstructured data as well as large volumes of incoming data in real time. Having a secure, accessible data warehouse allows insurers to tackle any data volume, variety and complexity, and sets the foundation for the use of other cloud-native BI and analytics tools.

2. Create and Standardize Data Models and KPIs

Through Power BI, insurers can set up data models and define their KPIs in conjunction with the business. Doing so will require the teams to cleanse and transform the data into logical relationships and hierarchies. The data can then be aggregated based on standardized KPIs. Having a taxonomy of standard KPIs and how they are derived will help ensure consistency in reporting across departments.

Data models and standardized KPIs empower business users to be unified in how data is collected, analyzed, and translated into insight. This supports centralized data use across teams, whether that’s enterprise BI or IT. A user-friendly data model will also empower business users to create their own dashboards and thus, develop an easy platform for self-service.

3. Create Meaningful Data Sets Based on Business Needs and Organization

Equipped with a well-designed data model, IT teams can then create siloed data marts with data for specific business needs, including day-to-day operations. Examples of data marts include customer 360 (for analysis on customer behavior), agents (for analysis of agent performance), quote (for analysis on new business), actuarial (for analysis on company risks), claims (for analysis on product profitability), and many more.

Through Power BI, these reusable and discoverable datasets are published to a shared, centralized workspace. Dependencies between datasets can also be tracked so that there’s visibility in the platform to monitor and garner insights. With the data sets defined for the various business operations, business users can now perform self-service as well as their own reporting and analysis.

4. Implement Data Governance for Compliance and Security

As business users work with a centralized datahub and workspace via Power BI, setting guidelines and governance measures around reports is crucial for security and compliance. Insurers need to confirm the safety of propriety and customer information, as well as thoroughly document decisions for legal purposes. When determining the guidelines for analytics governance, insurers need to figure out:

- Roles and responsibilities of reports management

- Authorization levels for different reports

- Adherence to industry standards and regulations

- Security controls for potential security breaches

These governance measures help maintain continuous compliance by monitoring data models and data quality. Discoverable datasets and accessibility carry their own risks—insurers must be extra-secure against privacy or security violations in their process to develop a self-service BI.

5. Run Power BI Training for Effective Data Use

Lastly, business users must be continuously trained for self-reporting capabilities and analytics to further reduce dependencies on IT. This also means fostering a culture of insights communication across all departments to demonstrate how data analytics can be used in the decision-making process. By building skills to communicate data insights, insurers can establish data storytelling as the new norm. This requires identifying data stewards, providing ongoing training and education as well as skill-building opportunities.

Empowering business with the knowledge and skills to use the data available without worrying about their lack of technical knowledge is key to self-service BI. As a result, users will feel well-equipped to innovate with data analytics and make better decisions for their operations in the long-term.

Accessible Business Insights to Empower Business Users

BI and reporting initiatives are complex undertakings, requiring legacy transformation and modernization — thus, a comprehensive approach to building foundational capabilities is crucial for success. Insurance companies acting without clear coordination across departments need to rethink their data analytics program and bring multiple perspectives and operations together under clear objectives.

By utilizing Power BI to enable self-service BI for business users, insurers can drive increased value from data and ensure consistency in data delivery. Ultimately, this improves turnaround time for reporting and data analysis and accelerates speed to market for business insights enterprise-wide.

Want to standardize BI operations and maximize investments in data analytics? Check out Value Momentum’s Data & Analytics services to start building a strategic approach to BI.